The changing world

The period that had seen the start of building and the population of Combe Down in the 1730s was little different from previous centuries.

The economy was based on agriculture for the vast majority and the way the world worked was still quite feudal.

By feudal I mean that the large landowners and people with political power were the nobility, gentry and church who were maintained by the rent on the land in the form of food, labour and money paid by their tenants.

Changes in the 18th century

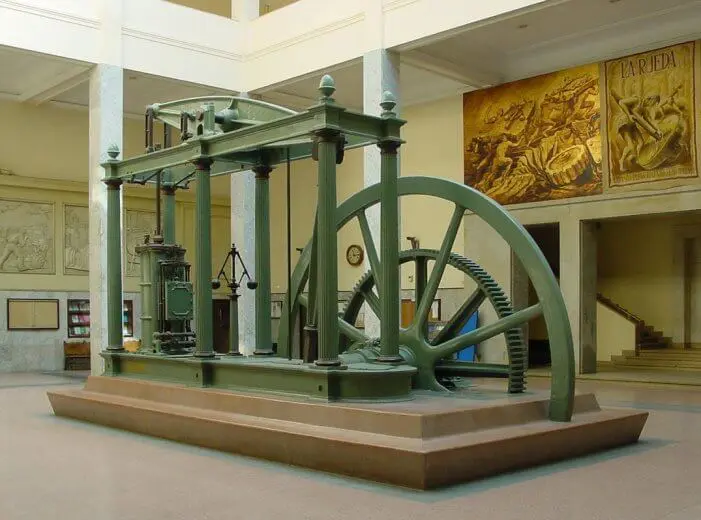

But, there were major changes in the 18th century. From 1700, the Scientific, Agricultural, Industrial, Communications, Transport and Financial Revolutions developed very fast compared with previous centuries.

In addition Britain had now established colonies and annexed territories worldwide to create an empire under the mercantilist philosophy – the philosophy being that government and merchants became partners with the goal of increasing political power and private wealth to the exclusion of other empires.

In 1700 56% of people worked in agriculture, 22% were in industry and 14% in services.

The population was about 5 million and less than 15% lived in towns.

Whilst most people worked on the land, it was not the greatest wealth generator. It is estimated that agriculture accounted for 27%, services[1] 34% and industry 39% of GDP.[2]

By 1800 the population had risen to about 12 million, nearly 25% lived in towns and productivity increases meant that 40% of people worked in agriculture, 35% were in industry, 25% in services.

This occurred as smallholdings were absorbed into large, rented, commercial farms and smallholders had to look for work as farm labourers or go to the towns to look for work in industry.[3]

With regards to GDP[4] it is estimated that agriculture accounted for 31%, services[5] 31% and industry 38%.

Population Growth

As previously stated, in 1668 Bath’s population was less than 1,200 and there were only about 150 houses.

By 1750 it was about 7,000, and 35,000 by 1801[6], making it one of the UK’s most populous towns.

It also had some of the best transport links in the country during the 18th century with improved turnpikes and the development of canals.

It was to grow to 60,000 by the end of the 19th century and 84,000 by the end of the 20th century but Bath’s relative importance and size diminished as industrial towns grew faster.

So Bath changed a great deal but, as we have seen, up to 1800 Combe Down had remained much as it had in Ralph Allen’s day and before.

But that was not to remain the case. As the Scientific, Agricultural, Industrial, Communications, Transport and Financial Revolutions continued throughout the 19th century, Combe Down became more than an outpost.

This was not just because of the growth of Bath but, as elsewhere in England, because the growing population saw greater wealth and had higher expectations than their forbears.

Real wages (wages measured in terms of the goods they will purchase) had not increased in the period 1700 – 1800. However in the period from 1780 – 1830 growth of up to 50% has been suggested by some[7], though most estimates are considerably lower. Nominal wages definitely rose though.

So a growing, more urban population needed more housing.

During each decade from 1790 to 1840 house building rose from 223,000 to 685,000.[8]

Some landowners wanted to diversify to take advantage of the money to be made in industry.

A growing financial sophistication meant that mortgages were not just available to the few but as those with wealth saw them as a relatively safe investment with a good yield.

The Financial Revolution

Extensive changes were brought about in the British financial system – the Financial Revolution[9] – between the Glorious Revolution of 1688 and the 1720s by the creation of a system whereby a national debt could be accumulated to provide government with spending power beyond the scope of taxation.

This became necessary as a result of the extensive military commitments undertaken between 1688 and 1815.

At the same time business, in order to expand, required a secure means for making payments, as well as a stable system of credit.

There were three main elements to this revolution: the use of the bill of exchange for financial transactions, trade in shares of the capital stock of corporations, and perpetual annuities issued by the government and thus free from the risk of default.

These developments had profound economic results.

They provided an institutional framework within which economic activity expanded, not only by creating a means by which provincial business could be transacted and linked to the main financial centre in London, but, perhaps more critically, by integrating London with the main European financial centre, Amsterdam, which by the end of the 18th century it had superseded.

Secondly they provided a conduit through which investment on an unprecedented scale could be mobilized.

Throughout the 18th century the principal customer remained the government. The state thus played a major role in stimulating the development of the financial system.

Banking also was different. Business men had to meet their own banking needs and country bankers were industrialists, traders, local revenue collectors, and other men already experienced in financial transactions such as lawyers.

Banking expanded rapidly. In 1784, there were 119 banks outside London; by 1797, there were 230, 470 by 1804, and 800 by 1809.[11]

Whilst the Financial Revolution was proceeding, it must be remembered that banks and building societies as we know them did not yet exist.

The first known building society was Ketley’s in Birmingham in 1775[10], but building societies were just that – mutual institutions with 10 – 20 members who paid a regular subscription and when there was enough money land was bought and houses built. Members all made payments until everyone had a house.

Most mortgages were still private though.

The increasingly rich merchant and middle classes took advantage of the changing world to make money.

Mortgagors came from a variety of stations in life: solicitors and barristers, widows and spinsters put in their savings but there were also many wealthy tradesmen. They would generally invest in a portfolio of mortgages to spread their risk, and mortgages might be for amounts between £100 and £500, at 5% interest (the maximum allowed by law at the time).

So, the Maude family sale of land in Bath occasioned by the substantial debts incurred by Cornwallis Maude, 1st Viscount Hawarden, meant that there were many people waiting to profit.

We have already seen that Edward Layton and others had seen the opportunities which led to the development of Isabella Place and created the Hadley Estate.

That was not the only building that occurred on Combe Down at this time. The De Montalt Mill was built on a 100 year lease from the De Montalt Estate in 1804, proving the De Montalt Estate was not completely broken up. Further to the East other buildings were going up too.

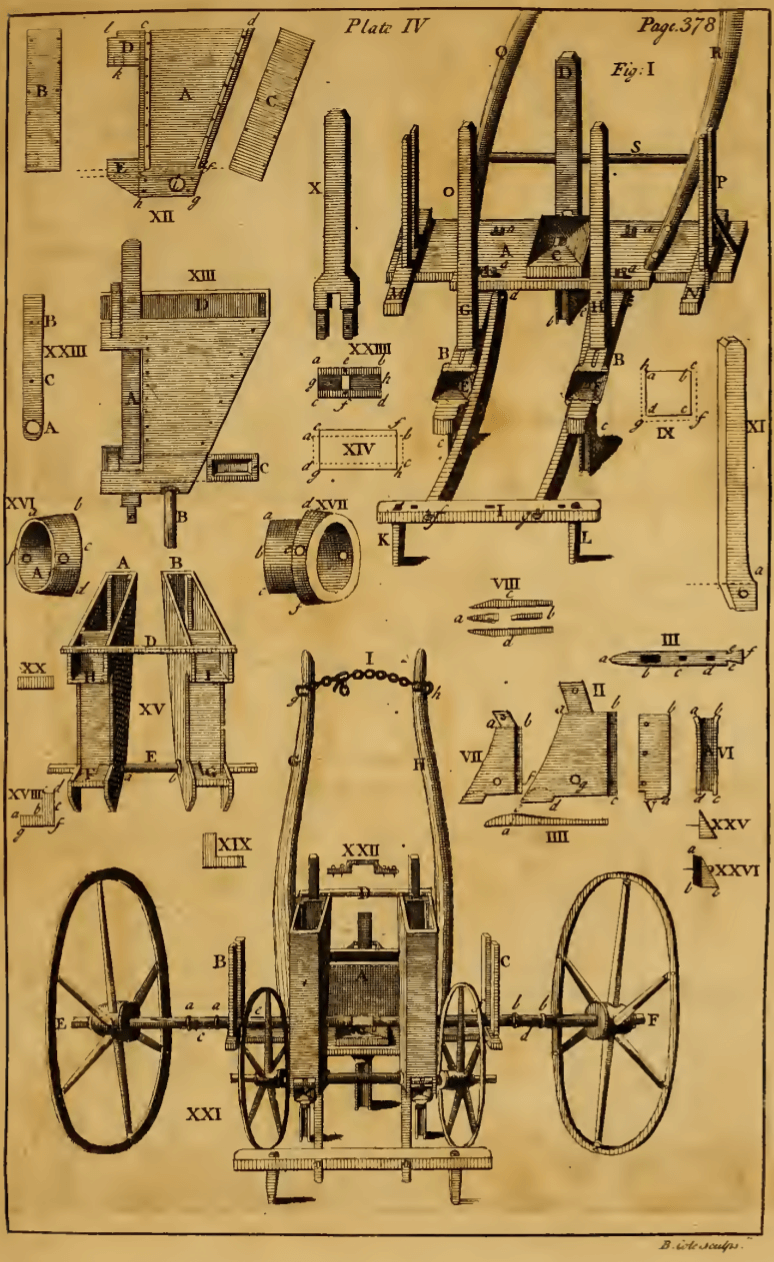

Some 18th century inventions

Contents